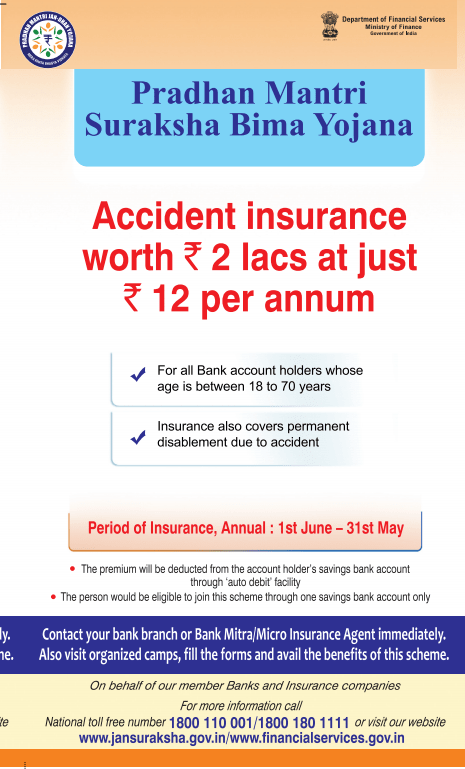

Important points of the Pradhan Mantri Suraksha Bima Yojana (PMSBY) – It is an accidental Death Insurance.

- Eligibility: Available to people in age group 18 to 70 years with bank account.

- Premium: Rs 12 per annum.

- Payment Mode: The annual premium will get directly auto-debited by the bank from the subscriber’s account.

- Risk Coverage: For accidental death and full disability – Rs 2 Lakh and for partial disability – Rs 1 Lakh.

- Eligibility: Any person with bank a bank account and Aadhaar number linked to the bank account can apply by just submitting the form to the bank every year before 1st of June. Nominee name to be given in the form at the time of applying.

- Terms of Risk Coverage: A person has to opt for the scheme every year. He can also prefer to give a long-term option of continuing in which case his account will be auto-debited every year by the bank.

- Who will implement this Scheme?: The scheme will be offered by all Public Sector General Insurance Companies and all other insurers who are willing to join the scheme and tie-up with banks for this purpose.

- The premium paid will be tax-free under section 80C and also the proceeds amount will get tax-exemption u/s 10(10D).But if the proceeds from insurance policy exceed Rs.1 lakh , TDS at the rate of 2% from the total proceeds if no Form 15G or Form 15H is submitted to the insurer.

- Rules English Hindi

- FAQ English Hindi

- Consent-cum-Declaration Form English Hindi

- Claim Form English Hindi

The official scheme website: www.jansuraksha.gov.in.

National Toll-Free – 1800-180-1111 / 1800-110-001

StateWise Toll free numbers: Statewise Toll-Free (pdf)

Any Question!