#Atal #Pension #Yojana #APY #scheme

Hoping to bring in more subscribers to its recently launched guaranteed pension scheme — the Atal Pension Yojana, the finance ministry last week brought in significant relaxations that allow members to make contributions on a monthly, quarterly or half- yearly basis and also permitted early exit before the age of 60 years.

The finance ministry’s decision provides major flexibility to subscribers, who were earlier mandated to make monthly contributions or face default charges ranging between Rs 1 and Rs 10 per month. Also, in case of discontinuation of contribution for six months, the account would be frozen and after another 6 months, it would be closed.

Further, as part of the premature withdrawal norms, subscribers who wish to exit the scheme before the age of 60 years, will only be refunded the contributions made by him to APY, along with the net actual interest earned on his contributions.

Strict rules also barred pre-mature withdrawals before the age of 60 years, except in case of death of the subscriber or terminal disease when only the accumulated funds in the APY account would be transferred to the nominee or spouse.

Experts have often pointed out APY to be too rigid for the vagaries of the life of unorganised sector workers. It may often be difficult to save every month, apart from the fact that not many workers may enjoy a long life to use their pension wealth.

However, the finance ministry’s move comes at a time, when the Employees’ Provident Fund Organisation or the EPFO is working to curb pre-mature withdrawals.

Under the EPF scheme, 12 per cent of workers’ basic wages up to a monthly ceiling of Rs 15,000 and a matching contribution of 12 per cent by employers are deducted as PF contribution every month. 8.33 per cent of the employer’s contribution is then diverted into the EPS.

But faced with a large number of premature withdrawals, EPFO is working to cap such withdrawals at 75 per cent of the total accumulation in case of loss of employment.

“The idea is to protect the provident fund corpus so that workers have a fallback option after retirement as they often withdraw all their savings while switching jobs. A majority of our 6 crore odd members come from blue collar jobs and this will ensure that they do not fall upon hard times in their old age,” said a senior official.

The cap on premature withdrawals by members would also be applicable in case of illness, marriage or higher education of a child and building of a house.

As a further deterrent on premature PF withdrawals, the Finance Act, 2015 levied from June 1 tax deducted at source between 10 per cent and 34.608 per cent on such withdrawals exceeding Rs 30,000 before completion of five years of service.

Further, concerns for pension or social security is steadily rising in the country as the “young population” gradually ages and experts have questioned the need to allow for premature withdrawal from the scheme.

“Allowing for premature withdrawals from a retirement saving scheme will dilute its purpose,” said D Swarup, former chairman, Pension Fund Regulatory and Development Authority, adding that the NPS was designed to allow for premature withdrawals only in case of terminal illness or house building.

“While the changes do dilute the concept of the APY, but pension at the time of superannuation comes across as a very theoretical concept for many people. Pensions mean different things to different people and many consider pensions as just another savings product that should provide some form of liquidity. For instance, even in the slightly more elitist NPS, many employees often have questions on intermediate liquidity,” said Amit Gopal, senior vice-president, India Life Capital Pvt Ltd

The Old Age Social and Income Security (OASIS) Project report in January 2000, which was in a way the genesis for the National Pension System, had projected that the number of aged in the country will rise to 179 million by 2026, comprising 13.3 per cent of the population, adding that nearly 90 per cent of the workforce was not eligible to participate in any scheme to save for old age security .

“According to the Ministry of Statistics, GOI, in India the elderly (aged 60 years or above) accounted for only 7.4 per cent of the population in 2001 which has increased to 8.4 per cent of the population in 2011. While India is ‘young’ with a median age of 25, the proportion of the elderly is set to rise to 10.7 per cent of the population by 2021 against a background of rapid transformation in household structures,” said the PFRDA in a recent note, adding that the average life expectancy at the age of 60 years is approximately 18 years in India.

Launched on May 9 this year, the APY is focused on unorganised sector workers and aims to “ensure dignified life in old age”, promising a guaranteed minimum pension of Rs 1,000, Rs 2,000, Rs 3,000, Rs 4,000 and Rs 5,000 to unorganised sector workers at the age of 60 years based on contributions.

To encourage enrollments, the government also promised to co-contribute 50 per cent of the total contribution or Rs 1,000 per year, whichever is lower, to the eligible APY account holders who join the scheme till December 2015, for a period of five years.

The relaxations were introduced by the finance ministry after wide consultations as it was facing an uphill task in enrolling members for the scheme, as against the other two accident and life insurance schemes that were simultaneously launched.

“Certain suggestions have been received, including from the states, regarding providing certain relaxations for informal sector workers, having intermittent incomes, from the provision of mandatory monthly contributions under the scheme of APY and also removing the penal provisions for non-contribution under APY to make the scheme more viable. The matter has been examined and the necessary revisions have been made in APY to increase the acceptability of the scheme amongst informal sector workers,” the finance ministry said in a statement.

Under the new provisions, that are “in favour of the subscriber”, the APY account will not be deactivated and closed till the balance with self-contributions minus the government co-contributions becomes zero due to deduction of maintenance charges and fees. Further, the penalty on delayed payment has been also simplified to Re 1 per month for contribution of Rs 100 for each delayed monthly payment instead of different slabs given earlier, the ministry added.

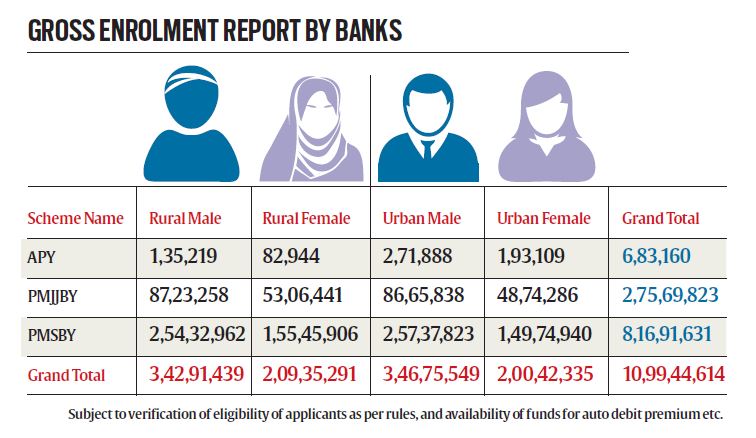

While the Pradhan Mantri Jeevan Jyoti Bima Yojana that provides a Rs 2 lakh life cover had 2.75 crore subscribers by August 22, the Pradhan Mantri Suraksha Bima Yojana that gives a Rs 2 lakh disability and accident insurance had 8.16 crore subscribers. In sharp contrast, the APY had just 6.83 lakh members in the period.

Concerned about the low enrollments, financial service secretary Hasmukh Adhia had said recently that the government is planning to push the product more through measures such as appointing private agents.

“The response to the APY is not so much as we expected it to be, so we need to push the product,” he had said.

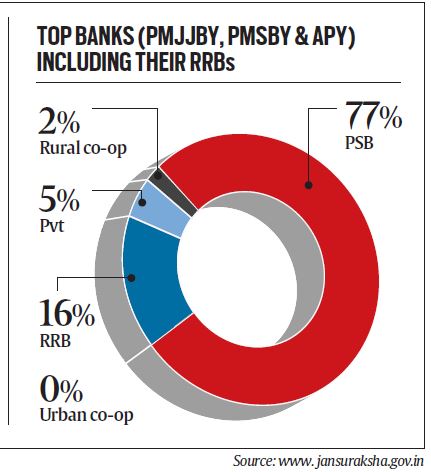

Accordingly, the pension regulator PFRDA is expected to appoint private agents or retirement advisors to sell the APY as against only banks which currently market the product to their customers. The rationale is that bank branches may often not have the time to explain the product to their customers, which can instead be done by agents.

source indianexpress

Any Question!