So far, the overdraft facility has been sanctioned in only 40,000 accounts, and only 8,000 have availed of it

Only 8,000 account holders have availed of the overdraft (OD) facility under the Jan Dhan Yojana, according to government sources. A total of 108 people have availed of the accidental insurance cover, while another 152 have taken the life insurance cover provided by the scheme.

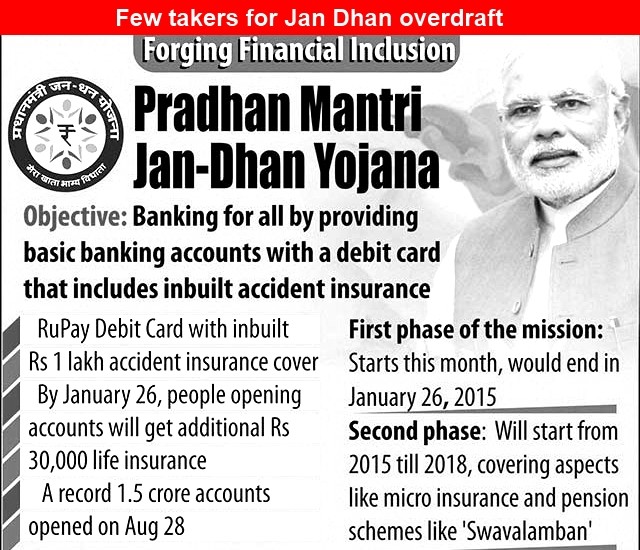

The Jan Dhan Yojana envisages extending households an overdraft facility of Rs 5,000 after satisfactory operation of accounts. As the overdraft can be offered only in accounts operated for over six months, only those that were opened before October 31 are currently eligible for the facility.

According to official data, 68.7 million accounts were opened under the scheme till October 31, of which 52.1 million had zero balance. The remaining 16 million accounts should ideally be eligible, but it is likely more than one account was opened per household, shrinking the number of those with overdraft facilities.

So far, the overdraft facility has been sanctioned in only 40,000 accounts, with only 8,000 availing of it. The average size of credit availed stood at Rs 2,500, according to government sources.

There are several possible explanations for the low offtake of the OD facility. It is possible that despite publicity for the Jan Dhan Yojana, there is limited awareness about the facility. Banks, too, are hesitant to sanction the overdraft because of the associated risks.

A note prepared by the department of financial services (DFS) outlines how these risks are to be covered. It has called for the creation of a Rs 1,000 crore fund to provide a guarantee against default. This corpus will be financed by the Financial Inclusion Fund maintained by the National Bank for Agriculture and Rural Development.

But according to sources at the All India Banking Association (IBA), the credit guarantee fund is likely to be created only in the next quarter.

The note added “there are 18.2 crore basic banking accounts and by the end of the campaign, another 15 crore accounts would be added. An overdraft of Rs 5,000 in each of these translates to a total of Rs 1,65,000 crore”. In other words, the scheme had envisaged extending the overdraft facility to every household.

But total credit extended to accounts opened under the Jan Dhan Yojana that are eligible for overdraft is a mere Rs 2 crore. This is lower than the overdraft being offered to basic savings bank deposit accounts. According to DFS, at the end of 2013, the overdraft facility had been availed by 3.92 million accounts for a cumulative Rs 155 crore.

For banks, the financial implications of providing an OD facility of Rs 1,65,000 crore without any security or recourse to funds to manage the risks associated can be immense. As they are already in a precarious position, if even a fraction of these overdrafts turn sour, it will have grave financial repercussions.

Another reason for the low numbers is the poor may find it difficult to meet eligibility criteria. As these accounts are likely to have very little of cash balances and the poor may not be regularly transacting through these accounts, it is quite plausible they simply may not be eligible for the facility. It was assumed that once the government switched to cash transfer of subsidies that these accounts would have the balance needed for the overdraft facility. The transfers would also help service the interest burden of the overdraft.

Currently, only the cooking gas subsidy, rural employment wages, old age pension and scholarships are routed through the system. Major subsidies like those for food, fertiliser and kerosene are not being handed out through cash transfers. This suggests that the OD facility could potentially take off better only if there is a significant ramp-up of the cash transfers programme.

NOT SATISFACTORY

- The Jan Dhan Yojana envisages extending households an overdraft facility of Rs 5,000 after satisfactory operation of accounts for six months

- About 68.7 mn accounts opened under the scheme till October 31

- So far, the overdraft facility has been sanctioned in only 40,000 accounts, and only 8,000 have availed of it

- Banks are also hesitant to sanction overdraft because of the risks associated

- The average size of credit availed stood at Rs 2,500, says a govt source

Any Question!