Personal accident cover is good but life insurance plan isn’t cheap and pension plan is rigid on withdrawals

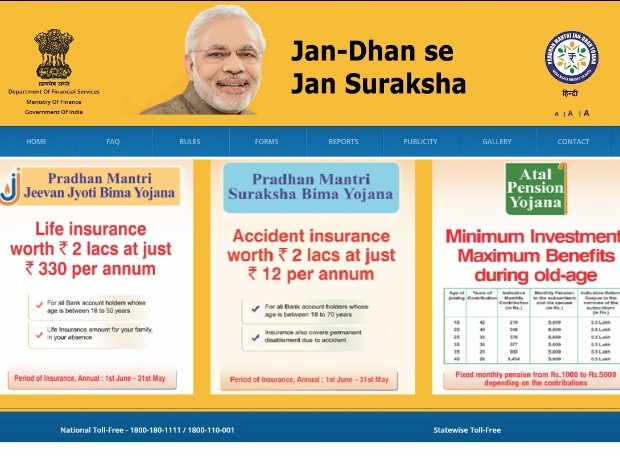

A few days earlier, three government policies – Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana and the Atal Pension Yojana – were launched with much fanfare. These primarily aim at affordableinsurance to the low-income segment.

At first glance, these appear attractive, with the low contributions required and that the premiums for both life and accident insurance policies are likely to remain the same for at least three years. And, these are open to all savings bank account holders, not only Jan Dhan account holders.

Yet, for all their benefits, each of these schemes do have their share of flaws, some more glaring than others. “Banks will push the schemes to meet their targets but my advise is to buy only if you are not adequately covered,” says Manikaran Singal, a Chandigarh-based financial planner.

According to Nilesh Parmar, chief operations officer, Edelweiss Tokio Life Insurance, processing of the claims might become a problem for the companies offering these schemes. “Since there is no requirement for medical tests, those with health problems might opt for these, which can make execution difficult for the insurers,” he says. He adds the companies are already seeing a significant number of claims from those registered with the Jan Dhan Yojana and, therefore, eligible for a free term cover of Rs 30,000 and accident cover of Rs 1 lakh. Let’s take a closer look at the benefits and flaws in these schemes:

The Pradhan Mantri Jeevan Jyoti Bima Yojana offers a one-year-term life insurance scheme, renewable annually. It is open for all savings bank account holders aged between 18 and 50 years. The sum assured is Rs 2 lakh, to be paid in case of death for any reason. The annual premium payable is Rs 330, to be debited from the bank account if you enrol before May 31.

Late enrolment is possible up to August 31, which may be extended for another three months. Those joining subsequently may be able to do so with payment of full annual premium for a prospective cover, with submission of a self-certificate of good health in a prescribed format.

Benefits: Apart from the low premium, one big advantage of the life insurance scheme is no requirement of a medical test and almost nil documentation, since these are linked to your bank account. “In most other plans, there is lot of documentation and medical examination. Here, all you require is a self-declaration. So, it is a positive from the customers’ point of view,” says Parmar of Edelweiss Tokio. The usual restriction of the sum assured not being paid in case of suicide within one year does not apply.

Fine print: By the thumb rule of taking a life cover equal to 10 times one’s annual salary, a cover of Rs 2 lakh might only be sufficient for someone earning Rs 2,000 a month. “For the ordinary middle class, it might make sense to purchase an online term insurance plan. If employed, they are probably already covered under group term schemes, which charge a lower premium,” says Saji George, co-founder, Policylitmus.com.

Term life insurance under the Jeevan Jyoti Bima Yojana is available at Rs 1.445 per Rs 1,000 sum insured. This is almost double the current commercial group policy rates, which vary from Rs 0.75 to Rs 1.25 per Rs 1,000 sum insured. “It appears the ordinary citizen buying life insurance cover under the Yojana is being overcharged,” says George.

Assuming the same ratio of Rs 330 premium for a sum assured of Rs 2 lakh, the premium for a term plan with sum assured of Rs 1 crore, would work out to Rs 16,500, not very cheap, points out Deepak Yohannan, chief executive officer (CEO), Myinsuranceclub.com.

The life cover ends at age 55. This means those wanting to extend their cover might have to buy a new term plan from the market, which can prove very expensive. A term plan for sum assured as low as Rs 2 lakh is not available unless under micro insurance. “You might get a life cover of Rs 2 lakh only through endowment or Ulip (unit-linked insurance) policies, where the premium for a Rs 2 lakh cover will be at least Rs 20,000 per annum,” says Singal. Adds Yohannan: “Most deaths happen after 55 years of age. So, if coverage stops at 55, the risky part of the business is removed for the insurance companies. It is almost zero risk for them. The plan might make sense only for those who are 40 years and above.”

Another disadvantage is that the premiums are subject to change after three years. So, if there are a huge number of adverse claims, the premiums could increase. In a regular term life plan, the premium remains the same through the tenure of the policy.

The Pradhan Mantri Suraksha Bima Yojana is a personal accident cover, along with a permanent disability benefit, offered by general insurance companies. It is open to anyone between the age of 18 to 70 years. The premium is Rs 12 per annum.

Benefits: Even if an accident does not result in death but causes permanent disability, resulting in irrecoverable loss of use of both eyes or hands or feet, an amount of Rs 2 lakh is paid by the participating insurance company. Says George of Policylitmus: “A premium of Rs 12 per annum for an accident policy that pays Rs 2 lakh and has permanent disability benefits is good value for money. Irrespective of whether one holds any other personal accident policy or not, it makes sense to pay Rs 12 under this scheme.”

Fine print: The low cover might not attract many from the middle and upper-middle class. Also, the amount of cover is reduced to Rs 1 lakh if the accident causing the permanent disability results in irrecoverable loss of only one eye or one hand or one foot.

The Atal Pension Yojana (APY) is a scheme focused on workers in the unorganised sector. The minimum period of contribution by the subscriber would be at least 20 years. Subscribers have the option to make monthly contributions. Those between 18 and 40 years of age are eligible. The scheme offers a guaranteed minimum pension of Rs 1,000, 2,000, 3,000, 4,000 and 5,000 per month, depending on the contribution. APY will replace Swavalamban Yojana (NPS Lite), which did not find many takers. Those registered with the latter will be automatically migrated to APY, with the choice of quitting it.

Benefits:”For any age band, the back-dated returns for this scheme come to about eight per cent, both for the accumulation and distribution phase. This is a fairly good commitment from the government, considering the rates are locked in for 50-60 years,” says Manoj Nagpal, CEO, Outlook Asia Capital.

Government’s co-contribution is available for five years, from 2015-16 to 2019-20, for subscribers who join between June 1 and December 31, 2015. This benefit is available only for those not covered by any statutory social security schemes and are not income tax payers. The government will co-contribute 50 per cent of the total contribution or Rs 1,000 per annum, whichever is lower.

Fine print: The amounts collected under APY are managed by pension funds appointed by the sector regulator, in line with the investment pattern specified by the government. Unlike the National Pension System (NPS), the subscriber here has no option to choose either the investment pattern or the pension fund. “The scheme is mostly targeted at the unorganised sector and the government is assuming these investors will not be savvy enough to choose between fund managers,” said Sandeep Shrikhande, CEO, Kotak Pension Fund.

APY has a more rigid structure than NPS when it comes to making an exit. Exit before 60 years of age is not permitted, except in the case of death of beneficiary or terminal disease. In NPS, investors are allowed to withdraw 20 per cent of the pension wealth in a lumpsum before turning 60, so long as the remaining 80 per cent is used to purchase a life annuity from an insurer. It also allows for partial withdrawal of up to 25 per cent of the contribution after 10 years by the subscriber, for higher education, marriage of children, purchase or construction of residential house/flat and treating specified diseases.

If you fail to contribute for six months, your account will be frozen; after 12 months, it will be deactivated, and after 24 months, closed. “There could be a lot of inactive accounts since the scheme is targeted at the mass population. It is not clear what will happen to these accounts and whether the money will be paid back to the person or not,” says Nagpal. There’s also a penalty of between Rs 1 and Rs 10 per month for delay in contributions.

HITS & MISSES

PRADHAN MANTRI JEEVAN JYOTI BIMA YOJANA

Hits

- Low premium

- No medical test or check required

- Minimal documentation

Misses

- Expensive compared to current commercial group policies

- Coverage stops at 55

- Premiums to increase after 3 years

PRADHAN MANTRI SURAKSHA BIMA

Hits

- Good value for money at Rs 12/annum

- Full payout even if person doesn’t die

Misses

- Cover too low for middle-class

ATAL PENSION YOJANA

Hits

- Attractive returns for the long haul

- Government co-contribution for five years

Misses

- No option to choose investment pattern or fund manager

- Exit not possible, except in case of death or terminal disease

- Account can be frozen or deactivated if payment irregular

Any Question!