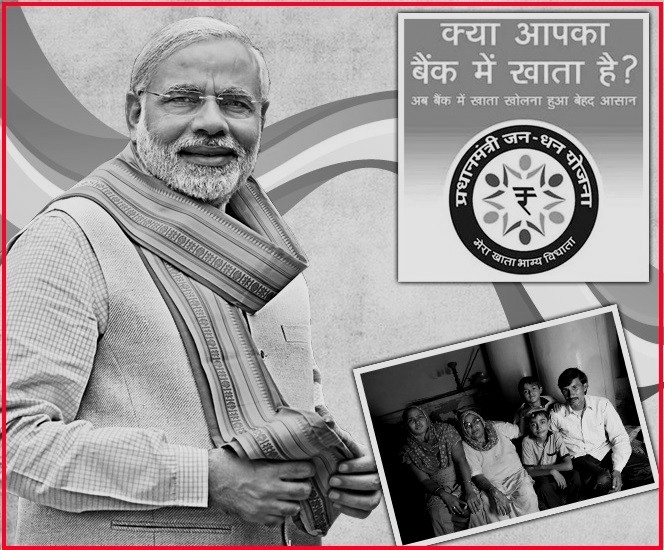

At the initiative of the governor of Nagaland, PB Acharya, all the staffers of Raj Bhavan have opened accounts and their salaries are being credited to their respective accounts now. 22 eligible fixed-pay/work-charged staff members have also opened bank accounts under the Prime Minister’s Jan Dhan Yojana Scheme (PMJDY) and drawing their pay through their bank accounts. The government of India launched the scheme on August 28, 2014, offering financial services and basic savings bank accounts, access to insurance and pensions to marginalized sections and low income groups.

Some of the main benefits of the scheme include RuPay Debit Card having inbuilt accident insurance cover of Rs.1 lakh, life insurance cover of Rs.30,000, loan facility up to Rs. 5,000.

The government of India has also launched three new schemes namely, the Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Suraksha Bima Yojana, and the Atal Pension Yojana.

The governor has appealed to citizens of the state to make full use of the schemes for their welfare.

Citizens’ fact-file: What is the PMJDY?

The PMJDY is a national mission for financial inclusion to ensure access to financial services, namely, banking/ savings and deposit accounts, remittance, credit, insurance, and pension ‘in an affordable manner’.

Account can be opened in any bank branch or Business Correspondent (Bank Mitr) outlets. PMJDY accounts are being opened with zero-balance. However, if the account-holder wishes to get cheque book, he/she will have to fulfill minimum balance criteria.

Documents required to opening PMJDY account

- If Aadhaar Card/Aadhaar Number is available then no other documents is required. If address has changed, then a self certification of current address is sufficient.

- If Aadhaar Card is not available, then any one of the following Officially Valid Documents (OVD) is required: Voter ID Card, Driving License, PAN Card, Passport & NREGA Card. If these documents also contain your address, it can serve both as Proof of Identity and Address.

- If a person does not have any of the officially valid documents mentioned above, but it is categorized as low risk’ by the banks, then he/she can open a bank account by submitting any one of the following documents:

- Identity Card with applicant’s photograph issued by Central/State Government Departments, Statutory/Regulatory Authorities, Public Sector Undertakings, Scheduled Commercial Banks and Public Financial Institutions;

- Letter issued by a gazette officer, with a duly attested photograph of the person.

Special benefits under PMJDY Scheme - Interest on deposit.

- Accidental insurance cover of Rs.1.00 lac

- No minimum balance required.

- Life insurance cover of Rs.30,000/-

- Easy Transfer of money across India

- Beneficiaries of Government Schemes will get Direct Benefit Transfer in these accounts.

- After satisfactory operation of the account for 6 months, an overdraft facility will be permitted

- Access to Pension, insurance products.

- Accidental Insurance Cover, RuPay Debit Card must be used at least once in 45 days.

- Overdraft facility up to Rs.5000/- is available in only one account per household, preferably lady of the household.

Eastern Mirror Nagaland

Any Question!