The private sector, which didn’t quite warm up to the call to open Jan-Dhan Yojana bank accounts to increase access to financial services, is cozying up to the government’s efforts to provide universal insurance.

With premiums close to market rates, companies including ICICI Lombard General Insurance, SBI Life Insurance and Star Union Dai-ichi Life Insurance are finding the government’s new schemes attractive.

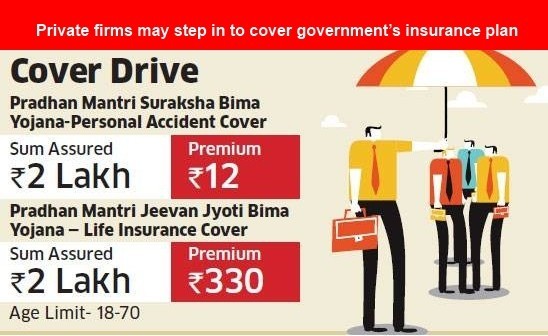

The government last week launched the Pradhan Mantri Jeevan Jyoti Bima Yojana to provide life cover of Rs 2 lakh at an annual premium of Rs 330 and the Pradhan Mantri Suraksha Bima Yojana for accidental death and disability at Rs 12 a year for a cover of Rs 2 lakh. The life insurance policy can be bought by people up to the age of 50 and the accident cover by anyone between 18 and 70 years old.

“The government is talking about insuring crores of underinsured and uninsured people,” said Girish Kulkarni, MD and CEO of Star Union Dai-ichi Life Insurance. “Risk estimates will emerge as we go forward.”

From the Rs 330 premium, Rs 44 goes to distributors and intermediaries. Stamp duty of Rs 40 is also deducted from the premium, leaving insurance companies with Rs 246 for a policy of Rs 2 lakh.

“It is difficult for us to offer a policy at Rs 12,” said Bhaskar Sarma, managing director and CEO at SBI General Insurance, a venture with Insurance Australia Group that started in 2010.

Any Question!